Finance says there is $100,000 in revenue. Meta says there is $80,000, Klaviyo says there is $40,000, GA4 says there is $85,000. Total business revenue is still $100,000. Nothing is broken. This is the predictable phenomenon of different methodologies, attribution windows and incentives.1

This is an attribution model explainer for ecommerce. If you care about eCommerce attribution or DTC attribution as budgets, promo calendars and inventory risk live on your desk, you are the audience. The goal is not perfection. The goal is attribution triage. You will Tuesday be endowed with a reconciliation workflow, default settings that dampen the noise, a worked example and a 10-minute monthly checklist of sorts.

Primary idea: treat attributions as a directional tool informing decisions already anchored to financial reality.

MER > Models: The Operator’s North Star

The Marketing Efficiency Ratio (MER), is calculated by dividing Total Revenue by Total Marketing Spend. It is a measure of marketing effectiveness, is agnostic to how your channels are organized, and is very difficult to “game” in terms of the number of marketing dollars spent in comparison to the dollars generated through sales. Therefore, use MER as your overall marketing guardrails when you have competing views from different platforms (e.g., eCommerce) on where to invest your next dollar of marketing spend.

For eCommerce companies struggling with measuring the ROI of their online sales (i.e., eCommerce attribution), MER can serve as an additional layer of protection to ensure that changes in your budget are directly correlated to actual increases/decreases in your sales.

Last month’s MER was 3.2 while the attributed revenue (from each eCommerce platform) fluctuated by approximately ±25% each week. MER remained consistent due to the fact that customers do not always follow a single path in order to purchase your product. Your model may fluctuate; however, the total relationship between the money you spend and the revenue you generate should remain constant.

Therefore, use MER to guide your budgeting and spending decisions. However, use your attribution data to guide your creative and audience direction. If MER remains strong and your attribution data is unstable, then there is likely an issue related to either tracking your conversions or overlapping data. This is not typically a reason to adjust your budget based upon the attribution data alone.2

Where Attribution Breaks: Platform Bias and Subscription Distortions

Platform bias you can predict

The purpose of ad platforms is to justify their cost. They use lookback windows and viewthrough credit which inflates totals. GA4 uses a customizable reporting attribution model and can go back in time to apply changes. Numbers don’t match up across tools. This is normal.3 4

Double attribution is prevalent. Klaviyo, Meta both win the same order. Your totals are > 100 % because each of these systems is solving for its own logic, not your P&L.5

Operational cost of ignoring this:

- Overspend risk from inflated ROAS.

- False confidence in channels that borrow credit from others.

- Distorted LTV & CAC muddy cash planning.

Subscription gotchas for CPG

A Second Layer Of Distortion Is Introduced By Subscription Revenue.

- Klaviyo default behavior. Klaviyo’s default attribution is based on the last touch within a window that also includes email open and click activity. When evaluating recurring brands, attributing an open to a broadcast campaign for a renewal that will happen regardless may inflate the amount of credit given to those campaigns. Switch to click-only attribution for sanity and consider shortening windows for your subscription sku.6 Note: Changing your attribution settings will cause historical data to be reprocessed, so prior periods’ numbers may restated; Document any changes made as part of your governance.7

- Recharge renewals. Renewals automatically fire without requiring user interaction. If you don’t take corrective action, Google Analytics 4 (GA4) and ad platforms will likely recognize the renewal as a new conversion and give credit to recent touches that did not influence the decision to renew. Maintain the original attribution from the time of acquisition for renewals and maintain a “New vs Renewal” split in all reports.8 9

- Hygiene in Decision Making. Separate New Orders from Renewals in every Performance View you use. Blending both will make your CAC look better than it really is and your LTV look larger than it really is. Your next purchase order will be justified by a mirage.

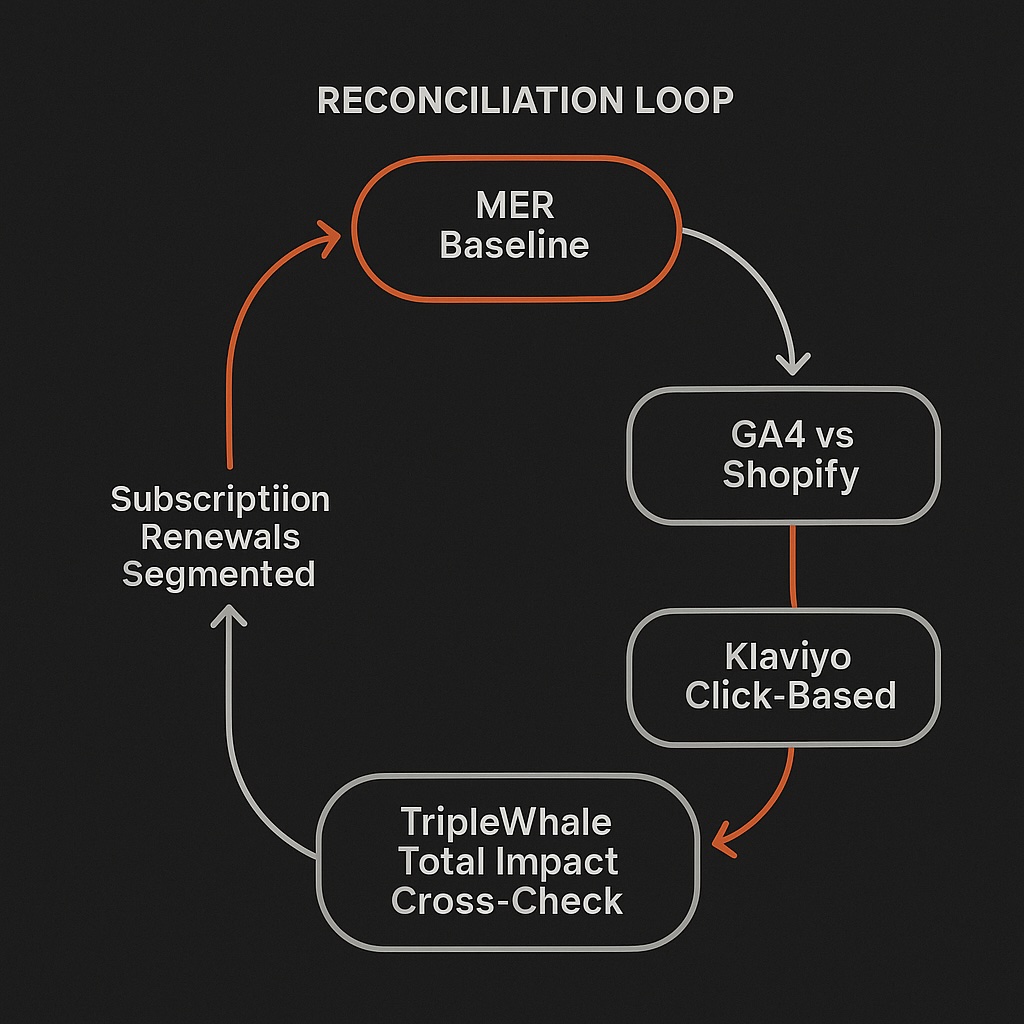

The Reconciliation Loop: From MER to Margin Truth

A single loop can create alignment between what an e-commerce platform claims and what occurs financially. Timing of execution of the loops does matter.

- First, establish the MER baseline for performance. If MER doesn’t look right, evaluate your overall strategy before spending time on pixel issues.

- Next, reconcile the GA4 data against Shopify’s. Understand that the total values will never equal each other. The most common reasons are time zones, cookie drop, modeled conversion, cancellations, partial refunds, and differing sessionization methodologies. Consider the general rule of thumb as 5 to 10% variance between platforms; use your own metrics to determine the proper variance for your store, and once determined use the root-cause list to find the cause of the difference in totals.10

- Layer on top of this the Klaviyo data. Compare and contrast the click based attribution to the inclusive open-view. Generally, the click based will be lower than the open-inclusive view, but closer to the real-world decisions being made by the shopper. Click-based data should be used for planning and analyzing margins

- Finally, cross-check with the TripleWhale Total Impact. The Total Impact adjusts for the over-credit of higher funnel channels, including brand search. Use the Total Impact as a directional cross-check, not as the sole source of truth. When the Total Impact and the platform dashboards differ, there typically is either an overlap or a window issue to correct.11

Settings That Quiet the Noise: A One-Page Configuration Guide

Present this as a table.

| Platform | Setting | Default | Change To | Why |

|---|---|---|---|---|

| GA4 | Reporting attribution | Data-Driven in many properties | Last non-direct click for reconciliation runs; Data-Driven for creative trend analysis | Easier alignment to Shopify when you need financial reality; DDA for insight |

| GA4 | Conversion lookback | Often 90 days | 30 days for most ecommerce cycles | Reduces stale credit that muddies current decisions |

| Meta Ads | Attribution window | 7-day click, 1-day view | Keep 7dC/1dV for standardization | Baseline for cross-platform comparisons |

| Google Ads | Model/window | Varies; many accounts now DDA | Temporarily use last-click or reconcile in GA4 with last non-direct click; align click window with Meta where possible | Improves cross-platform comparability during reconciliation |

| Klaviyo | Email attribution | Last-touch with open and click windows (e.g., 5 days) | Click-only; shorter window for subscription products | Stops ghost credit on renewals, mitigates MPP open inflation |

| Shopify | UTMs and source tracking | Varies by team | Enforce a strict UTM schema and landing page tagging | Keeps checkout source usable in reconciliation |

| Subscriptions | Revenue segmentation | Often mixed | Separate new vs renewal across all dashboards | Prevents CAC and LTV distortion |

Worked Example: Reconciling Reports For Margin Truth

Scenario: a 7-day sitewide promo with paid support. Forty percent of revenue comes from subscribers.

Raw reports

- Shopify: $100,000

- GA4: $86,000

- Meta: $55,000

- Google Ads: $18,000

- Klaviyo, open-inclusive: $42,000

- Klaviyo, click-only: $28,000

- TripleWhale Total Impact: $94,000

Pre-processing

- Split revenue: New orders vs renewals (Recharge). Keep renewals out of paid credit unless there was a paid click in-window. Maintain a separate renewal dashboard for lifecycle analysis.

Adjustments

- Overlap removal. Identify orders credited to both Meta and Klaviyo. Remove the duplicate credit from email unless there was a click in-window.

- Renewal separation. Attribute renewals to lifecycle systems or “renewal” bucket, not prospecting/retargeting by default.

- Tie-breaker. When channel claims conflict, use GA4 last non-direct click as the arbiter for reconciliation views (you can keep DDA separately for creative insight).

After overlap removal

- Channel-attributed sum settles at $98,500 against Shopify $100,000. Variance is 1.5 percent, within tolerance.

- Composition note: the $98,500 reflects reconciled paid social + paid search + click-attributed email + direct/organic totals with renewals segmented out and duplicate claims removed.

- So what: If you’d taken open-inclusive email and platform totals at face value, you would have greenlit a 20 percent budget increase and squeezed gross margin by roughly 1.5 points next month. With reconciliation and MER guardrails, you hold spend, fix creative fatigue, and protect cash.

The Attribution Sanity Checklist

Run this monthly. It takes ten minutes.

- Confirm GA4 reporting model for reconciliation is last non-direct click.

- Standardize ad windows at 7-day click, 1-day view.

- Verify Klaviyo is click-only for reporting; shorten windows for subscription SKUs.

- Segment subscription renewals from new revenue across all dashboards.

- Compare platform totals to Shopify revenue. Treat ~5–10 percent variance as normal guidance; investigate outliers.

- Cross-check TripleWhale Total Impact for brand-search overcredit.

- Recompute MER and compare to last month.

- Flag channels with >15 percent variance vs Shopify or last month’s pattern.

- Document methodology changes (attribution models, windows, tagging).

- Update promo calendar assumptions if attribution shifts affect expected lift.

CTA: Download the Attribution Sanity Checklist.

Key Takeaways

- Attribution is directional, not judicial.

- MER beats models for budget and pacing.

- Subscription renewals must be segmented or they will poison CAC and LTV.

- Consistent settings plus reconciliation deliver margin-true reporting.

FAQ

Use GA4 last non-direct click for reconciliation views and Data-Driven for creative insights. The model follows the decision, not the other way around.

Segment renewals. Do not credit them to paid or broadcast email without a click in-window. Keep Klaviyo in click-only mode and maintain a separate renewal dashboard.

Different windows, view-through credit, and incentives. Expect overlap and remove it. Do not total platform claims and compare the sum to Shopify.

Guideline: ~5–10 percent is common for many stores. Larger gaps deserve investigation before you change budgets or forecasts.

References

- https://help.shopify.com/en/manual/reports-and-analytics/discrepancies ↩︎

- https://www.triplewhale.com/blog/marketing-efficiency-ratio ↩︎

- https://support.google.com/analytics/answer/10596866 ↩︎

- https://business.facebook.com/business/help/460276478298895/ ↩︎

- https://searchengineland.com/marketing-attribution-models-the-pros-and-cons-451733 ↩︎

- https://help.klaviyo.com/hc/en-us/articles/4416803987739 ↩︎

- https://help.klaviyo.com/hc/en-us/articles/11118357030555 ↩︎

- https://support.getrecharge.com/hc/en-us/articles/9828306941207-Recharge-metrics-and-Klaviyo-flows ↩︎

- https://developers.google.com/analytics/devguides/collection/ga4/ecommerce ↩︎

- https://support.google.com/analytics/answer/10597962 ↩︎

- https://kb.triplewhale.com/en/articles/7128379-the-total-impact-attribution-model ↩︎